rhode island state tax id number

Small Business Administration - Rhode Island. One of several steps most businesses will need to take when starting a business in Rhode Island is to register for an Employer Identification Number EIN and Rhode Island state tax ID numbers.

Contact Us Ri Division Of Taxation

State of Rhode Island General Laws.

. With respect to the employer state number ID it wont really matter what you input in Box 15 Employer ID as long as the software will accept it explained below. Things can be complicated but use our service and we. They let your small business pay state and federal taxes.

THERE ARE 4 RI NUMBERS. Search by entity name Corp LP LLP LLC Non-resident Landlord Enter name. A Rhode Island tax ID number is a business tax id and also a federal employer number.

BusinessOccupationalBusiness Tax Receipt Number. Taxable Wage Base - 24600 per employee. A state tax id can be a state tax id employer number or a wholesale Rhode Island tax ID number.

Rhode Island Sales Tax. However as with anything dealing with this agency the process can be quite confusing. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes payroll taxes and withhold taxes from.

In either case we. If you are interested in using the Portal and have not already received a PIN letter in the mail you may request a PIN by contacting the Rhode Island Division of Taxation via phone 4015748484 or email taxportaltaxrigov. Then there is a business license number that you get and it is essentially another Rhode Island tax ID number.

General Information on State Sales Tax Resellers Permit Tax Certificates Business Registration Wholesale License. Many business owners find it is much simpler to use Govt Assist LLC to secure a tax ID number. If youre an independent contractor you can find this number in the Payers Federal Identification.

Heres what tax id number s and permit s you legally need to get before starting your business. GovDocFiling makes it easy on you. Begins with Exact match Full text Soundex.

File for Rhode Island EIN. City and Town Information. Even for businesses and entities that are not required to obtain a Tax ID EIN in Rhode Island obtaining is suggested as it can help protect the personal information of the individuals by.

To protect your data you will need a Personal Identification Number PIN to link your account. Uses of Rhode Island Tax ID EIN Numbers. Simply enter as many digits as you can from the number you have as printed on your W-2 starting from the beginning left-side.

As such most companies keep their tax ID numbers private so you probably wont find it published on the companys website. Your state tax ID and federal tax ID numbers also known as an Employer Identification Number EIN work like a personal social security number but for your business. You Need a Business Tax Receipt License because all businesses are required to get one a fictitious business name DBA a Federal Number and a State.

This is a general business tax number also called a Tax ID or home occupation permit that all businesess MUST obtain. At Govt Assist LLC we make the process as easy as possible. If youre an employee of a company look in box B on your W-2 statement.

2022 Filing Season FAQs - February 1 2022. Read the summary of the latest tax changes. Begins with Exact match Full text Soundex.

To get a Rhode Island tax ID number you need to apply to the IRS. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business. Search by an individual name Officer Director etc Search type.

What number do I call if I have a question. A Business Tax ID 39. First youll need to have a federal tax ID in place which you can get in less than an hour via the online application.

The Rhode Island DMV does not accept an ITIN as a form of identity. Rhode Island sales tax is collected with. You will need to contact the agency that issued you the Form 1099-G to obtain the state ID number.

Latest Tax News. SrJames Carvalhovitch Other LLC. By allowing GovDocFiling to assist you with applying for Rhode Island tax ID number you can eliminate any risk of long delays or incorrect submissions which could jeopardize the hard work youve put into your business.

RI Employer Account Number if available 10 Digits including leading zeroes RI Tax ID. The application process for getting a state tax ID number in Rhode Island isnt much different than the process for applying for a federal tax ID number even though theyre managed at different governmental levels. 26100 for those employers that have an experience rate of 959 or higher 2022 Tax Rate - 021 percent 00021 The Job Development Fund Assessment will be 021 percent for calendar year 2022.

PPP loan forgiveness - forms FAQs guidance. However many documents require the number. The 2021 new employer rate was 021 percent.

Wholesale trade shows and merchandise marts usually require a state sales tax identification number in order to allow your business to participate. RI State Employer Tax ID Number. Tax ID for Ebay Home Business business in Chepachet RI Registration.

Does the State of Rhode Island initiate or automatically deduct the payments. Sales RI State Tax ID Number Sellers Permit Federal Employer Tax ID Number. State of Rhode Island Division of Taxation Form RI-2441 50000 Adult and Child Day Care Assistance and Development Tax Credit Name Federal.

Ebay Home Business Tax ID Registration in Chepachet RI Retail Trade LLC For An Ebay Business. Please have your reference number and tax ID number ready. Masks are required when visiting Divisions office.

See the link below and select the applicable state to find out how to contact your particular state. You may call 401-574-8484. Obtaining a Rhode Island Tax ID EIN is a process that most businesses Trusts Estates Non-Profits and Church organizations need to complete.

The amounts on this form are reported to the taxing agencies and matched with the amounts reported on your tax return. You must have a valid social security number or an acceptable denial letter from Social Security with an acceptable visa code. GovDocFiling Eliminates the Guesswork in Obtaining a Tax ID Number.

2021 New Employer rate - 095. RI Business Tax Registration ID Business License Question. Individual Taxpayer Identification Number ITIN.

Fillable Rhode Island Last Will And Testament Form Free Formspal

How To Get A Resale Certificate In Rhode Island Startingyourbusiness Com

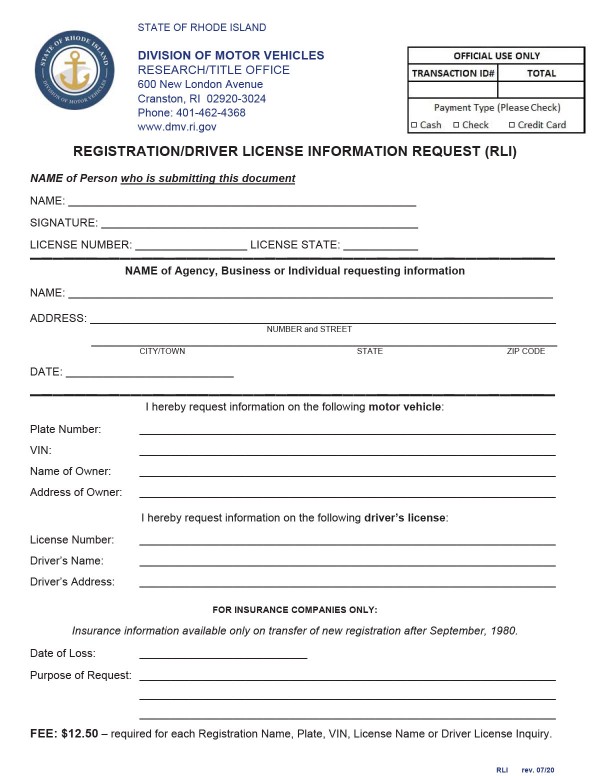

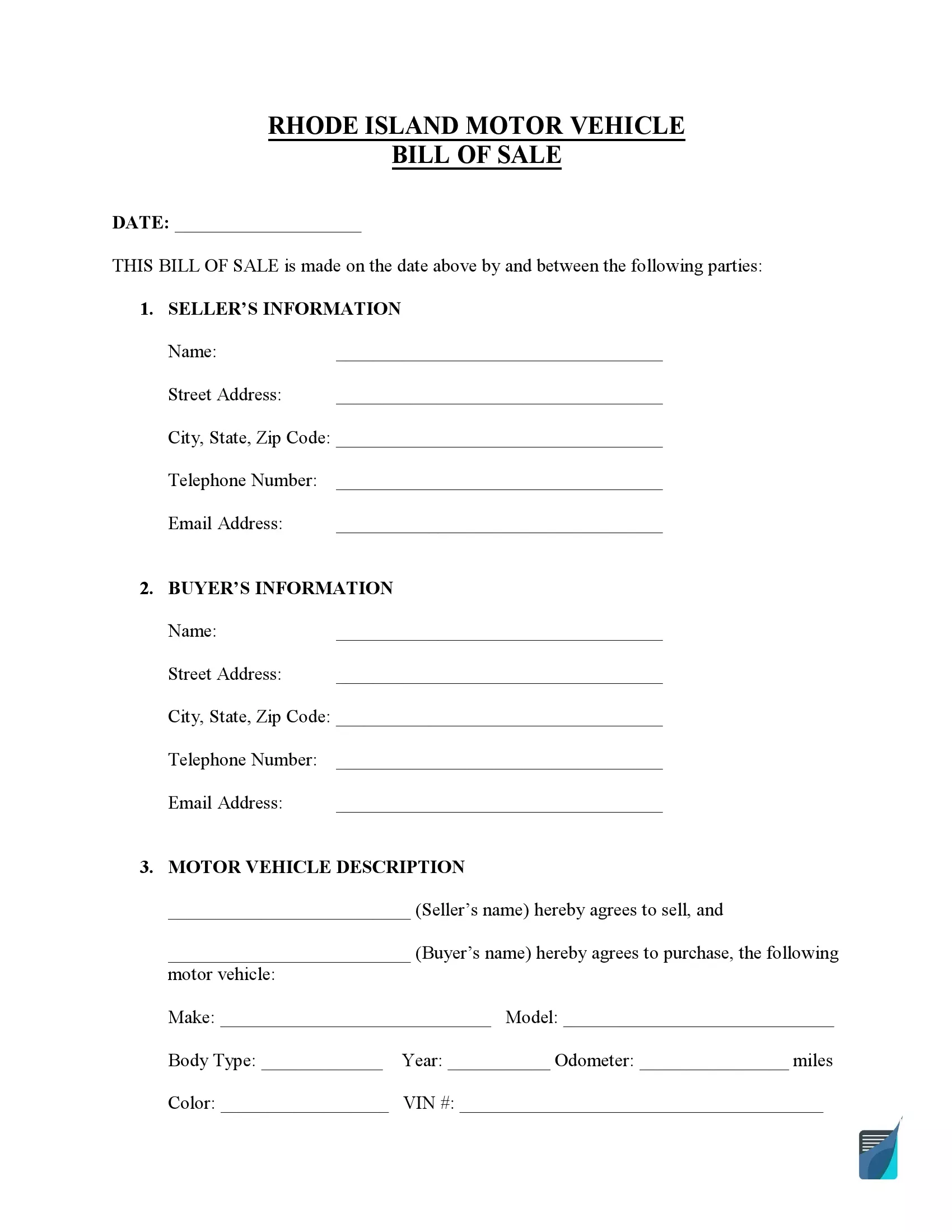

Free Rhode Island Bill Of Sale Forms Pdf

All About Bills Of Sale In Rhode Island Facts You Need In 2020

Rhode Island Notice Of Deficiency Letter Sample 1

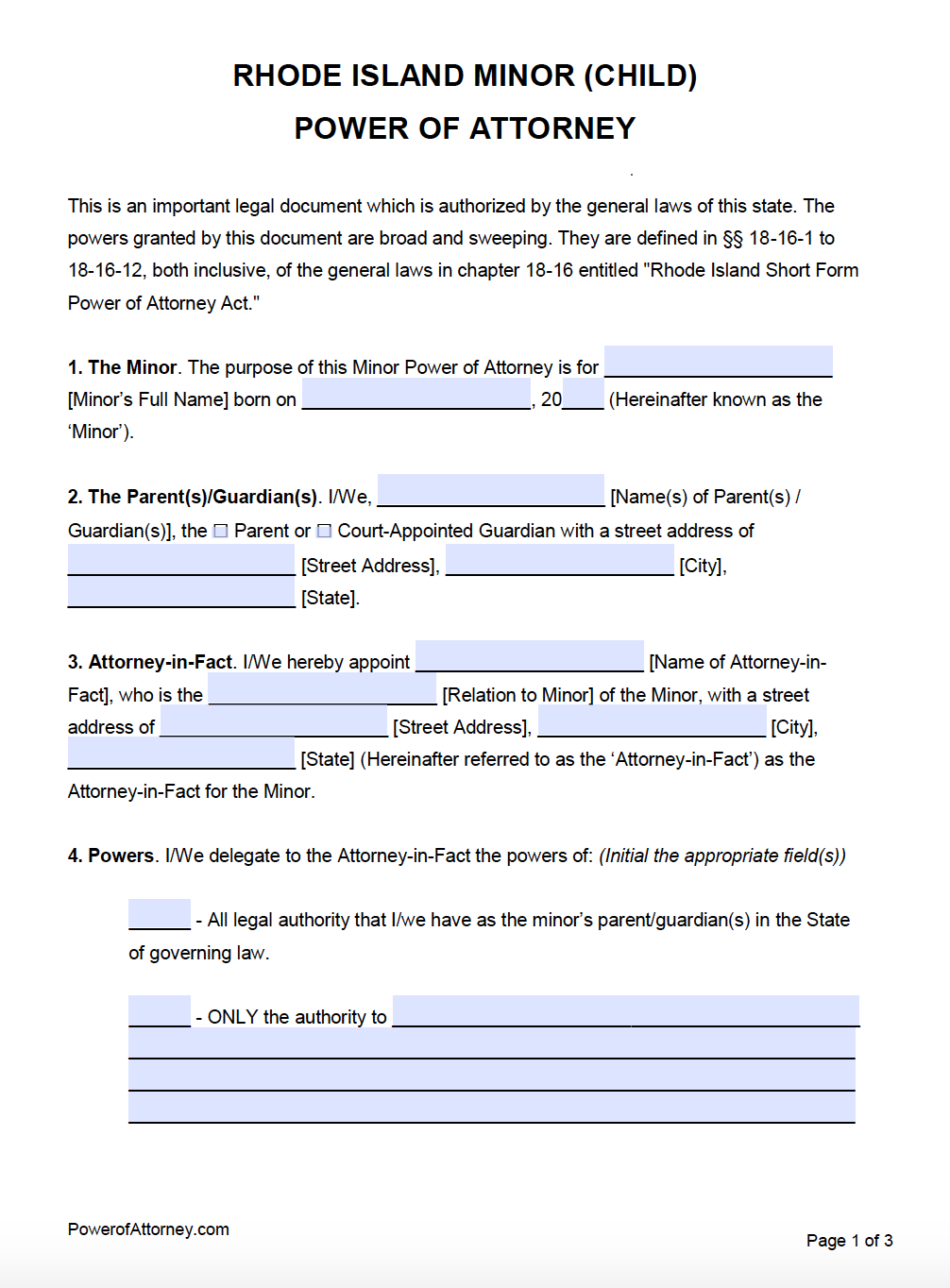

Free Rhode Island Power Of Attorney Forms Pdf Templates

Free Rhode Island Bill Of Sale Forms Formspal

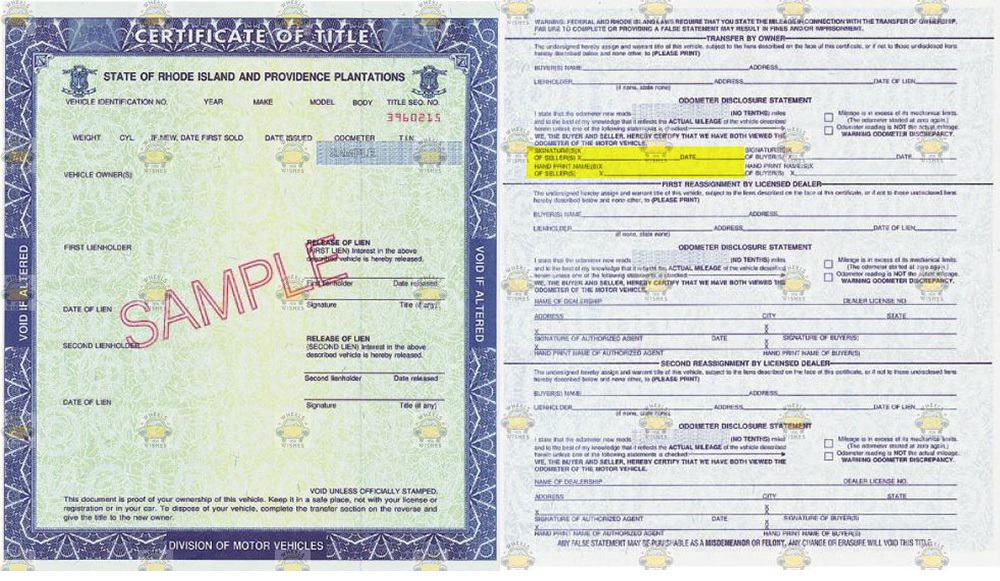

Title Questions For Rhode Island Vehicle Donations

Rhode Island Sales Tax Small Business Guide Truic

Free Rhode Island 5 Day Demand Notice For Non Payment Of Rent Pdf Word Professional Reference Letter Resignation Letter Template Free Letter Templates Free

How To Register For A Sales Tax Permit In Rhode Island Taxjar

Rhode Island State Tax Information Support

Rhode Island Tax Id Ein Number Application Manual Business Help Center

About The Office Rhode Island Office Of The General Treasurer